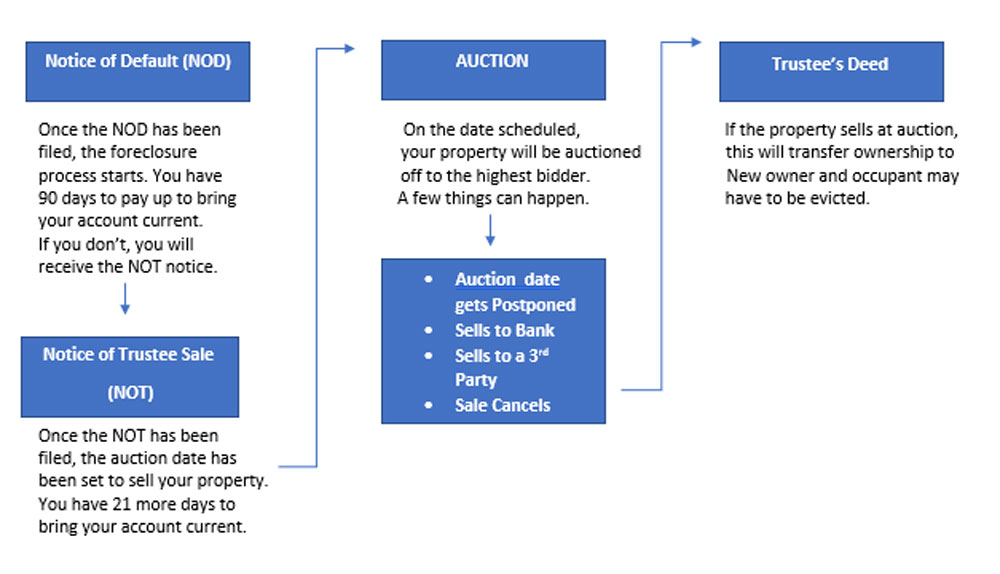

Like many Americans, you are not the only one who has had a DEFAULT ACTION filed against you. You may have received a Notice of Default (NOD) or may have already been served with a Trustee Sale Notice (NOT). In these matters, time is of the essence and there are some vital pieces of information you must consider when you are in this situation.

You have approximately 3 ½ months from the date of the filing to pay all of the arrearages, legal fees, and filing fees OR your property may be sold at a public auction, then be Foreclosed upon and you may lose your property.

Do not take this time period lightly because time is not on your side. You must at one begin to arrange to borrow the needed money by refinancing your home or getting a second or a third mortgage to satisfy the debt. This may not be done easily as your credit has now been impaired because of the Default filed against you. If you cannot refinance, then consider other sources such as a business loan or a personal loan.

You may also consider selling your property. In this HOT market, your home is probably worth a great deal more than you owe it. A sale may bring you a substantial amount of cash back to enable you to start over again. However, to better assess your situation, we will need to review your property details and financials to advise on what is the best next course of action. We have extensive experience with helping clients in your predicament.

Foreclosure Process